Introduction:

Welcome to our comprehensive guide to the Voluntary Carbon Market. If you’ve been wondering how companies offset their carbon emissions or how the planet benefits from it, then keep reading.

We’ve got everything here: from the ABCs of the VCM to the nitty-gritty of project types, and from the big WHYs to the HOWs. And don’t worry, we’ve made sure to break it down in a way that doesn’t require a PhD in Environmental Science to understand. So let’s get started.

Section 1: Understanding the Voluntary Carbon Market

What is the voluntary carbon market and how does pricing work?

The voluntary carbon market is a marketplace for buying and selling carbon credits. Unlike the regulatory or compliance carbon market, which operates under government-mandated carbon reduction programs, the voluntary market is driven by companies and individuals looking to offset their carbon footprint voluntarily. In addition, the pricing of carbon credits, determined by supply and demand dynamics, plays a significant role in the functioning of the market.

- The Price of Carbon Credits: An Overview

- The Voluntary Carbon Market Explained

- What is the Voluntary Carbon Market?

- State and Trends of Carbon Pricing 2023

- Carbon Pricing Dashboard

- Carbon Pricing – Where the Market Currently Is and Where It Must Go

How does the voluntary carbon market work?

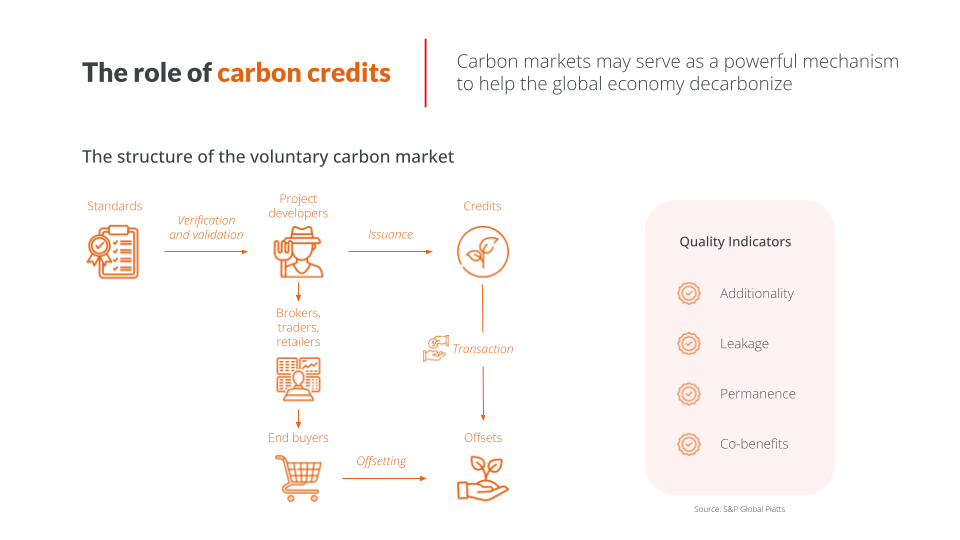

The voluntary carbon market operates through the trade of carbon credits. Each credit represents the removal or avoidance of one metric ton of carbon dioxide (CO2) from the atmosphere. Businesses offset their emissions by purchasing these credits from projects that reduce or sequester greenhouse gas emissions.

How are carbon credits created?

Carbon credits are generated from projects that avoid, reduce, or remove greenhouse gas emissions. Each credit equates to one tonne of carbon dioxide (CO2) that has been prevented from entering the atmosphere. The generation of these credits involves a thorough process of project design, validation by an independent third-party, monitoring of the project’s performance, and verification of emission reductions.

Section 2: Utilizing the Voluntary Carbon Market

Why should companies participate in the voluntary carbon market?

Engaging in the voluntary carbon market offers a multitude of benefits. It allows companies to take responsibility for their environmental impact and signals to stakeholders a commitment to sustainability. Participation can also spur innovation within the company, drive new partnerships, and create positive social impacts.

- Definitive Buyer’s Guide to Carbon Credits

- How the voluntary carbon market could help us get to net zero

Who buys carbon credits?

A wide range of entities purchase carbon credits. These include companies seeking to offset their carbon emissions, investors looking for environmental, social, and corporate governance (ESG) opportunities, governments aiming to meet their climate targets, and even individuals wanting to reduce their carbon footprint. The diversity of buyers underscores the global commitment to combat climate change.

- Who buys carbon offsets – and why?

- Carbon offsetting for businesses explained

- Meaning, benefits and why your organization should do it

Section 3: Regulations, Rules, and Market Trends

What are the regulations and standards governing the voluntary carbon market?

While there is no regulation of the voluntary carbon market, a number of frameworks and standards, such as the Verified Carbon Standard (VCS) and Gold Standard, provide the foundations. These standards – often also referred to as registries – involve third-party verification and ensure the credibility of carbon credits.

Some of these standards include:

- Verified Carbon Standard

- Gold Standard

- American Carbon Registry

- Climate Action Reserve

- Puro.earth

- Plan Vivo

- BioCarbon Registry

Separately, there are a few international entities working to enforce quality, increase clarity and encourage participation in the voluntary carbon market. These include:

- The Voluntary Carbon Market Integrity initiative (VCMI): Organization aiming to help clarify demand-side use of carbon credits, through the VCMI Claims Code of Practice

- Integrity Council for the Voluntary Carbon Market’s Core Carbon Principles (CCPs): This set of principles aims to set a floor in terms of quality, and evaluates the standards themselves (e.g. Gold Standard, Verra) on whether they meet the standards

- Science Based Targets Initiative (SBTi)’s Beyond Value Chain Mitigation: SBTi supports corporates in setting science-aligned emissions reduction commitments, and offers guidance on how to use carbon offsets, particularly as part of Beyond Value Chain Mitigation – or carbon ‘contribution’ rather than ‘offset’

What are the different project types in the voluntary carbon market?

In the voluntary carbon market, different methodologies are used to calculate emission reductions and to issue carbon credits.

These can be categorized as nature-based vs. engineered: nature-based credits involve natural systems like mangroves and grasslands, whereas engineered carbon projects involve human-made activities like factories and agricultural lands. Credits can also be categorized as removal vs. avoidance credits: removal credits suck carbon directly from the atmosphere, whereas avoidance (or reduction) credits stop carbon emissions from happening in the first place.

Carbon credit methodologies are dependent on the type of project, and can vary from reforestation methodologies, renewable energy methodologies, to methodologies for improved agricultural practices. Each methodology provides detailed procedures for quantifying emission reductions and ensuring that they are real, measurable, and verifiable. There is also a surge in new and emergent carbon capture technologies, such as direct air capture or bioenergy with carbon capture and storage (BECCS), contributing to emission reductions.

Examples include:

- Biochar : A type of charcoal produced from plant matter, used to enhance soil fertility and sequester carbon, thus helping to mitigate climate change.

- REDD+: Reducing Emissions from Deforestation and Forest Degradation) is a United Nations-led program that incentivizes forest conservation and sustainable management in developing countries, aiming to reduce emissions and increase carbon storage.

- Enhanced Rock Weathering: A technique that involves grinding up certain types of rock and spreading them over large areas of land to capture CO2 from the atmosphere and store it in the soil.

- Afforestation: The process of planting trees, or sowing seeds, in a barren land devoid of any trees to create a forest.

- Woody Biomass: Refers to trees and woody plants, including limbs, tops, needles, leaves, and other woody parts, grown in a forest, woodland, or tree plantation, that are used as a source of renewable energy.

Examples of successful voluntary carbon market projects

Numerous projects within the voluntary carbon market have brought about tangible, positive change, both environmentally and socially. Let’s take a closer look at a few of these remarkable initiatives.

- Mytrah Wind Power India

- THE KASIGAU CORRIDOR REDD PROJECT

- The Greater New Bedford LFG Utilization Project

Section 4: Market Trends in the Voluntary Carbon Market

What are the challenges, considerations, and market trends for companies?

While the voluntary carbon market offers many benefits, companies must navigate potential pitfalls and challenges, such as ensuring transparency of purchased offsets, and staying updated with evolving regulations. Current market trends and predictions, such as potential regulatory changes or predicted market growth, can help businesses adapt their strategies and stay ahead.

- Against Greenwashing: What the EU’s Green Claims Directive Means for Your Business

- Transparency is improving but action should be priority

- Carbon Capture, Removal, And Credits Pose Challenges For Companies

- Current market trends and predictions

Aren’t carbon offsets greenwashing?

While there has been concern over “greenwashing” – a practice where companies exaggerate or falsify their environmental contributions – reputable voluntary carbon market standards have robust criteria to ensure that carbon credits represent genuine emission reductions. It’s crucial for companies to carefully select their offset projects, and opt for those that are third-party verified, contribute to sustainable development goals, and are beyond business-as-usual practices. This due diligence can help ensure that the purchase of carbon credits results in real and meaningful climate action.

- Mythbusters Guide: Blockchain in the VCM

- How to Spot Greenwashing: When Companies Aren’t as Green as They Claim

- Is Carbon Offset a Form of Greenwashing?

- Fear of Greenwashing

Conclusion:

Navigating the voluntary carbon market can seem complex, but understanding its mechanics, benefits, and challenges can greatly help companies striving for carbon neutrality. It’s crucial to remember that carbon credits should complement, not replace, direct emission reduction efforts. The voluntary carbon market provides an opportunity to offset unavoidable emissions and contribute to meaningful climate projects around the world. By participating, companies can show leadership, stimulate innovation, and foster positive environmental and social change.