In recent years, carbon markets have evolved into essential tools for mitigating the impact of greenhouse gas emissions, with both voluntary and compliance markets playing distinct but increasingly interconnected roles.

The need to reach global net-zero by 2050 has pushed these markets to the forefront of climate action strategies. Looking forward, the convergence between voluntary carbon markets (VCMs) and compliance carbon markets (CCMs) could represent an important step in scaling climate efforts and ensuring market integrity.

This post explores the differences between these markets, the implications of their convergence, and the potential benefits and challenges of a more unified approach.

Distinguishing compliance and voluntary carbon markets

Carbon markets broadly fall into two categories: compliance and voluntary.

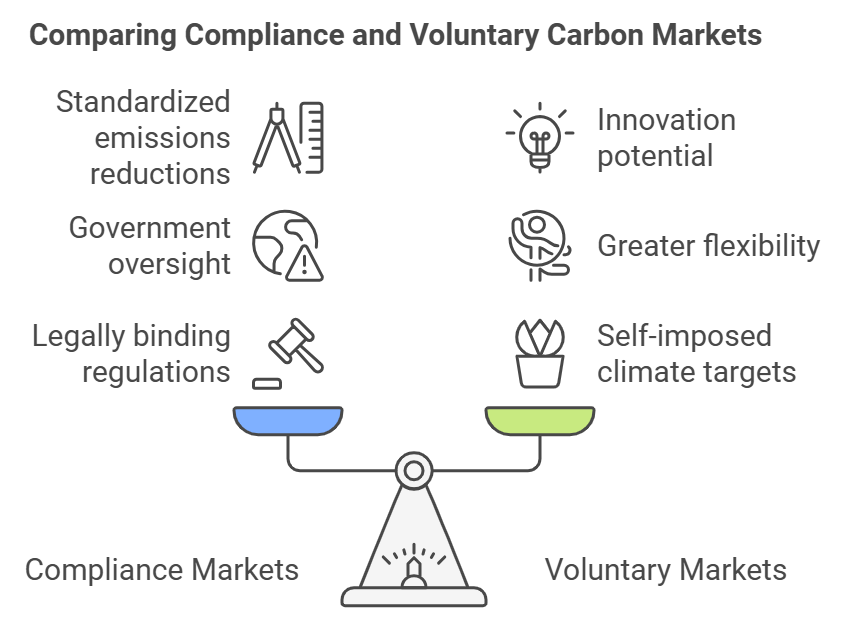

Compliance markets are created through regulatory frameworks that enforce emissions reductions by setting limits or caps. These often operate through a cap-and-trade system where entities trade emissions allowances. Examples include the European Union emissions Trading System (EU ETS) and California’s Cap-and-Trade program, which were roughly $770bln (2023) and an estimated $9.3bln (2024) in size, respectively. These markets are legally binding to the organisations encapsulated within the regulation, with non-compliance penalties and government oversight ensuring accountability and standardised emissions reductions.

Conversely, voluntary markets enable companies and individuals to purchase carbon credits to meet self-imposed climate targets that go beyond regulatory requirements. These markets have been widely used to finance carbon-reducing projects such as reforestation, renewable energy, and clean technology initiatives.

The voluntary aspect allows for greater flexibility and innovation, although the lack of regulatory oversight has raised concerns about inconsistent standard and claims of greenwashing.

What convergence could look like

The growing interconnection between voluntary and compliance markets suggests a shift towards unified frameworks, where voluntary credits may increasingly play a role in regulated carbon markets.

This integration can take different forms, from the voluntary credits meeting specific compliance standards to shared methodologies for evaluating and certifying emissions reductions.

Examples of early convergence efforts include Singapore and South Africa, where governments have integrated voluntary credits within compliance regimes. Singapore’s carbon tax regime, for example, allows companies to offset up to 5% of their tax liability using eligible international carbon credits. This approach provides flexibility for companies in the method in which they meet their tax obligations whilst simultaneously funnelling finance to approved carbon projects.

Unlike traditional tax regimes, Article 6 of the Paris Agreement provides a framework that could harmonise compliance and voluntary carbon markets, allowing countries to collaborate on emissions targets and use credits across borders.

Article 6.2 facilitates bilateral agreements for trading emissions reductions (ITMOs), enabling countries to incorporate eligible voluntary credits into their compliance frameworks if they meet set standards.

Meanwhile, Article 6.4 introduces a centralised, UN-supervised crediting mechanism that enforces strict environmental standards, lending credibility to credits used in both voluntary and compliance markets. This structure could streamline quality standards and enhance transparency, helping to create a cohesive global carbon market that supports both regulatory and voluntary climate action.

At the time of writing, there has been a much anticipated and necessary breakthrough on Article 6.4 implementation at COP 29 in Baku. The agreement sets out an integrated and global carbon mechanism, overseen by a UN body, for the trading of emissions mitigation units created globally by various projects. It is intended to replace the existing UN led crediting agencies that developed many of the early methodologies (see: clean development mechanism).

Benefits of a unified market approach

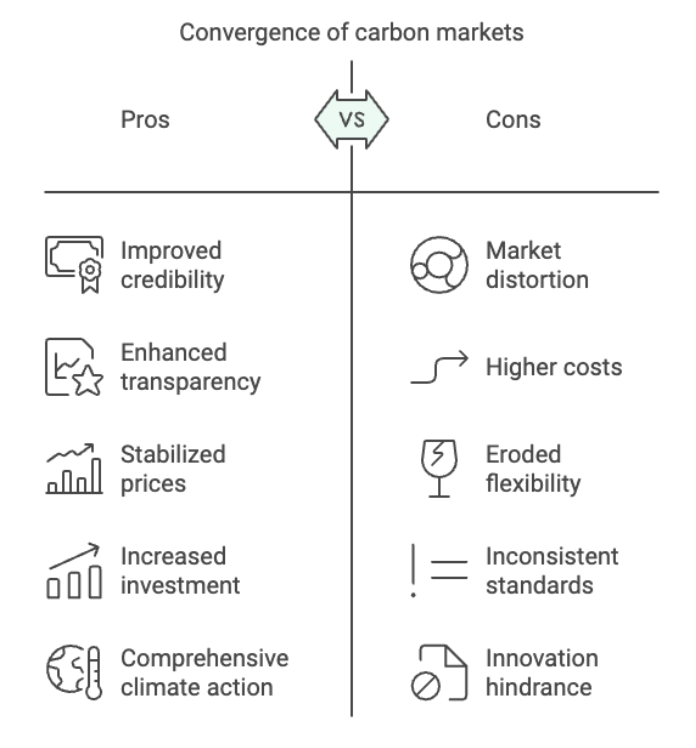

The convergence of voluntary and compliance markets could yield several advantages for the VCM and particular project methodologies.

First, it would improve the credibility and transparency of the voluntary market by adopting the regulatory rigour from compliance markets. This further reflects ongoing alignment on standards within the VCM, as seen with the adoption of the Core Carbon Principles by the UK government, underscoring a growing commitment to high-quality, standardised emissions credits. This harmonisation makes it easier for buyers to understand the value of their credits and increases confidence in the environmental impact of their purchases.

Additionally, a greater convergence would lead to a more robust supply and demand structure. Compliance markets, which tend to be more regulated and predictable, could stabilise prices and investment flows in the voluntary market.

In turn, voluntary markets, which are known for their innovation, could introduce new types of credits, such as innovative carbon removal credits, that compliance markets might otherwise struggle to integrate due to the financial and delivery risk associated with developing and implementing new carbon removal methodologies.

Convergence also fosters more comprehensive and ambitious climate action. As the voluntary and compliance markets integrate, their combined efforts can create a clearer and more coherent path toward global emissions reductions. For hard-to-abate industries where achieving net zero is currently technologically or economically challenging, access to high-quality voluntary credits within compliance frameworks provides a crucial bridge to meeting stringent climate goals.

Challenges and risks of convergence

Despite its potential, the convergence of voluntary and compliance markets is not without challenges.

A significant concern is the risk of market distortion. Convergence could lead to competition for high-quality credits, raising costs for voluntary buyers and possibly constraining access for companies not subject to compliance requirements.

Moreover, blending the markets could erode the voluntary market’s flexibility. Innovative and novel carbon methodologies within the voluntary markets have thrived without the typical restraints applied to heavily regulated compliance constraints. The imposition of compliance-like standards could impede innovation in the voluntary market as projects struggle to meet regulatory criteria that may not fully align with the more experimental nature of voluntary initiatives.

Another concern is the potential for inconsistent standards across regions, which may create confusion and hinder the global adoption of a unified system. For instance, while the EU ETS has stringent requirements for credits, other regions with nascent compliance markets might adopt less rigorous standards. This lack of uniformity could dilute the overall quality of credits and undermine the efficacy of the convergence.

Conclusion: A positive step with careful consideration

The convergence of voluntary and compliance carbon markets has the potential to make a significant, positive impact on climate mitigation efforts. By blending the innovation and flexibility of voluntary markets with the rigour and accountability of compliance markets, a more efficient, transparent, and effective global carbon market could emerge.

However, this transition requires thoughtful planning and a commitment to balancing market integrity with innovation.

Regulators and industry stakeholders must work collaboratively to address potential risks, ensuring that the benefits of convergence are not offset by increased costs, reduced access, or compromised quality.

Convergence should not merely be seen as a means to align standards but as an opportunity to elevate the ambition and credibility of all carbon markets.

Through careful management, convergence can enhance the role of carbon markets in driving us closer to a sustainable, net-zero future.